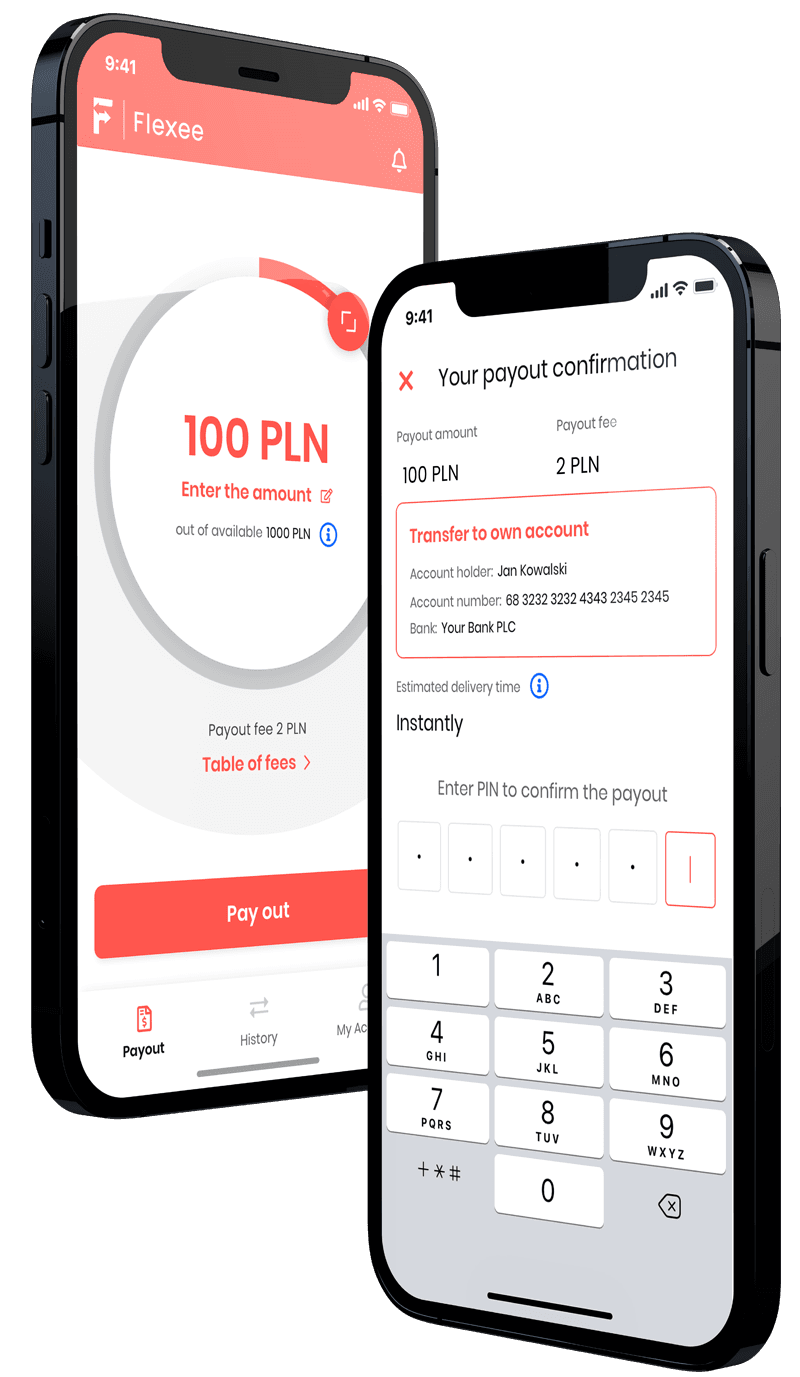

Employees are not required to use Flexee. They may have access to a part of the money already earned, in the amount set by you, only when they need it.

Flexee umożliwia pracownikom dostęp nawet do 100% ich miesięcznego dochodu netto (z możliwością ograniczenia na żądanie), gdy tylko go wypracują (ukończą zaplanowaną i zatwierdzoną zmianę lub dzień pracy). To pracodawca decyduje, do jakiego procentu wynagrodzenia netto chce dać dostęp pracownikom.

Funds paid to your employees by Flexee are deducted from their next official remuneration as deductions for Instant Pay loans. Each deduction is made on the basis of the power of attorney that the employee grants in the Flexee app with each payment. The employer has access to the administration panel of the Flexee system with a preview of powers of attorney granted. It can limit the amount to be paid to e.g. 50% of net income earned (with the possibility of further limitations on request). This avoids a situation in which the employee would receive a payout higher than their net salary.

Flexee doesn’t change anything here. The funds provided by Flexee are deducted from the salary for the relevant tax period, including tax, social security contributions and any other adjustments (such as holiday pay, bonuses, uniform and accommodation costs, expenses, etc.). The employer may set individual rules and preferences related to additional benefits.

Employees can only access a limited part of the money they have earned, e.g. up to 50% (with the possibility of a reduction on request). As a result, the employee leaving the company will not be able to pay out more than they are entitled to (even if there is no notice period). During the notice period, the employer may – from the Flexee administration panel – easily block Instant Pay for the employee. Upon departure, the employee will no longer be able to make a payout. Any money already received through Flexee will be deducted from the employee’s last salary.

The employer may block the employee’s payouts at any time. Payouts block is activated within a couple of seconds. The employee’s balance in the app will then be 0 PLN and the employee will not be able to payout any money. Flexee allows payouts of already earned funds, so the employer will not be charged with any additional costs. In addition, if the contract is terminated through no fault of the employer, Flexee has the right of recourse to the employee, as Instant Pay agreement that the employee concludes in Flexee app is a loan agreement concluded between Flexee and the employee.

No. The employer pays the employees’ wages as normal, reduced by the amount set within the Instant Pay service. There is no risk that this will delay your payroll. Flexee has been designed to seamlessly adapt to the principles of employee remuneration systems.

Flexee finances the early payment of remunerations for employees until settlement with the employer. This does not affect cash flow. There is also no risk of overpaying employees’ remuneration from future settlement periods. On the date the employer’s payrolls are settled and the payroll for the month is processed, all employee balances in the Flexee app become zero. During this time, Flexee sends a consolidated deduction report to the payroll department. No employee will get a payout from Flexee until the day following the day they receive their remuneration.

Yes – in a positive way. Flexee can reduce employee turnover, as confirmed by independent studies of companies operating in other European markets. Less rotation means lower costs in the company.

The Flexee app is designed to provide benefits for both employees and employers. By offering Flexee, companies improve recruitment and staff retention, increase productivity and employee commitment. Meet with us and we’ll present you the stories of customers we’ve helped with increasing the general efficiency within their organisations.

Yes, it is. Algorithms take care of security. All data is stored in secure databases on vendor-managed servers on a global scale. We use proven technology used by well-known banks. Our technology helps to verify the user during registration with data from their ID card.

Yes, it is. Flexee Finance sp. z o. o. is on the list of loan institutions of the Polish Financial Supervision Authority